Stay in the know

New Water Benchmark for financial institutions

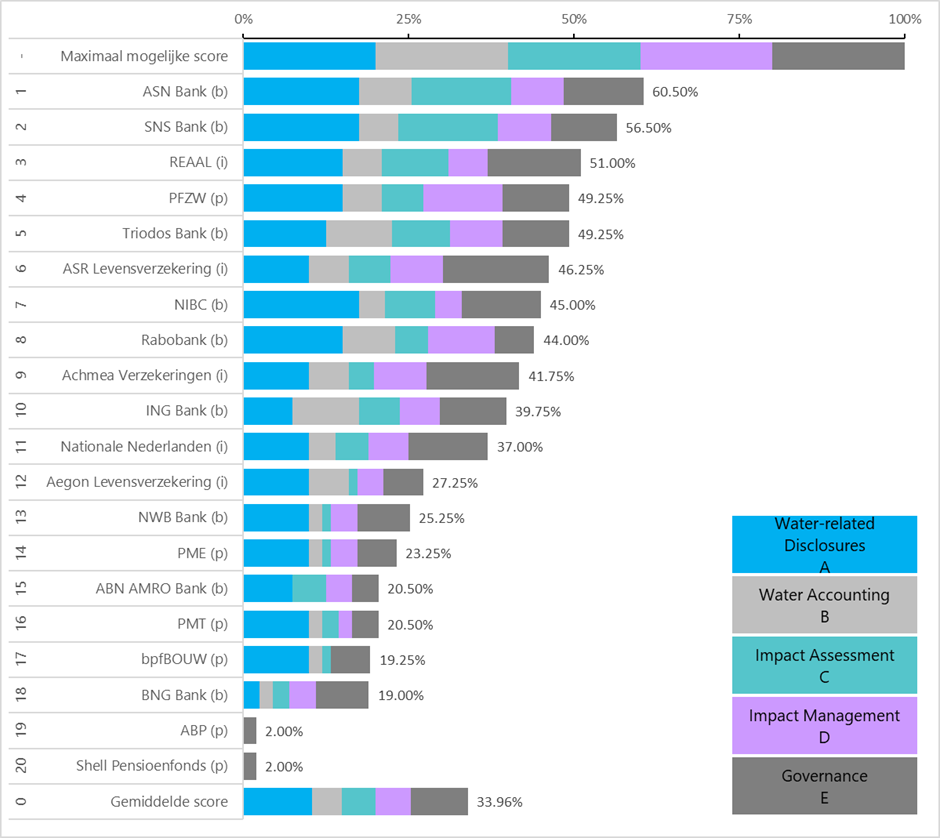

The “Water Sustainability Benchmark for Dutch Financial Institutions” was carried out for the third time this year. The comparison over time shows that there is cautiously more attention being paid to water in the investment policy of the Dutch financial sector, but with major differences between the institutions. ASN Bank is at the top of the rankings for the second time, and SNS Bank and REAAL also score well. Pensioenfonds Zorg en Welzijn (PFZW) is the best performing among pension funds (see Figure).

In 2018, the first Water Sustainability Benchmark for Financial Institutions was launched to assess the extent to which FIs include water sustainability criteria in their investment policy. In 2023, an improved version of the benchmark was carried out on the initial 20 largest Dutch financial institutions, to monitor trends and report on progress.

Five categories and 27 criteria were used to assess the FIs against publicly disclosed data. A point system is used to score the FIs on each of these criteria. The FIs are then ranked based on the scores to evaluate how well a particular investor is performing compared to their sector peers.

Ranking (#) and scoring (%) of twenty of the largest Dutch financial institutions on the extent to which they include water sustainability criteria in their publicly disclosed policies

Not without risk

Of the twenty FIs assessed for incorporating water criteria into their investment strategies, only three scored above 50%, with lowest scores at 2% and a varied range in between. We see that even the top 3 rated FIs only achieve between 50% and 60.5% of the maximum score (100%), leaving room for improvement even among top performers.

The results of the 2023 benchmark show that many Dutch FIs have a blind spot when it comes to water. This puts both assets and environmental resources at risk. Publicly disclosed sustainability policies are often only vaguely and broadly addressing water. Goals, targets and action plans are rarely clearly formulated, especially in relation to investment, lending or underwriting portfolios.

Oncoming climate-related crises which express themselves through water, such as more intense droughts and floods, will expose financial institutions to increased physical, reputational or regulatory risks. At the same time, FIs have significant influence to bring about positive change as their investment decisions can have a significant impact on water resources worldwide.

For more information, please contact Jaap Feil at jaap.feil@waterfootprintimplementation.com